Blog > March Market Recap - Lower Kittitas County

This is a recap of what happened in the real estate market for the Lower Kittitas County Area (Ellensburg, Kittitas, Thorp & Vantage)

Resdientail Real Estate

47 - Homes Listed for Sale

37 - New Pending Sales

26 - Homes Closed - Ranging form $269,500-$1,1,000,000.

56% more homes were listed than in Feburary 2022 and 36% more than March 2021. We historicallay see an increasing in homes coming on the market in Ellensburg through the months of March-May and level off throughout the summer and start to decline in the fall. Ellensburg seems to follow the school cyle and the months without snow. (go figure, most people dont want to move in a snow storm.)

March had 27% more pending sales than Feburary 2022 because there were more homes avalible for buyers to purchase. This is also a 21% increase in the number of pending home sales compared to March 2021.

The number of homes closed homesonly increased by 1 home compared to Feburary. Keep in mind homes typically take 35+ Days to close in our market and we've seen more sellers asking for delayed closings to have time to find or move to their next home. Homes are going under contact quickly but we have seen some longer contract to close times. The number of closed sales was up 36% from March 2021

Homes Are Selling Quickly

16 out of the 26 homes went under contact in 7 days or less, Thats 64%.

Closed Sale Details

6 - Sold for under asking

5 - Sold for full asking price

15 - Sold for OVER asking price

Only 6 homes sold for under the sellers original list price or listing price. We look at original list price because this would account for any price reductions prior to going under contract. The homes that sold for under asking was the least expensize home at $269,500 and the 5 homes that sold over $700,000-1,100,000. ALL of the other buyers paid full asking price or more.

The most a buyer paid over the sellers asking price was 13%. The average a buyer paid above asking was about 5%.

How buyers purchased the Homes?

5 - Cash

1- Private Lending (Hard Money)

2- VA Loan

18 - Contional Loans

Things Buyers did to get there offers Accepted?

-Included a 22AD - A form that say you wil bring in a set amount of additonal funds if the property does not appraise for the sales price. This is in additional to your downpayment and closing costs. This can be used with any loan type!

-Short inspection (5 days or less), Some waived inspection or had a preinspection done.

-Submitted offers early, not the day of offer review.

-Have a good team (Agent and Lender)

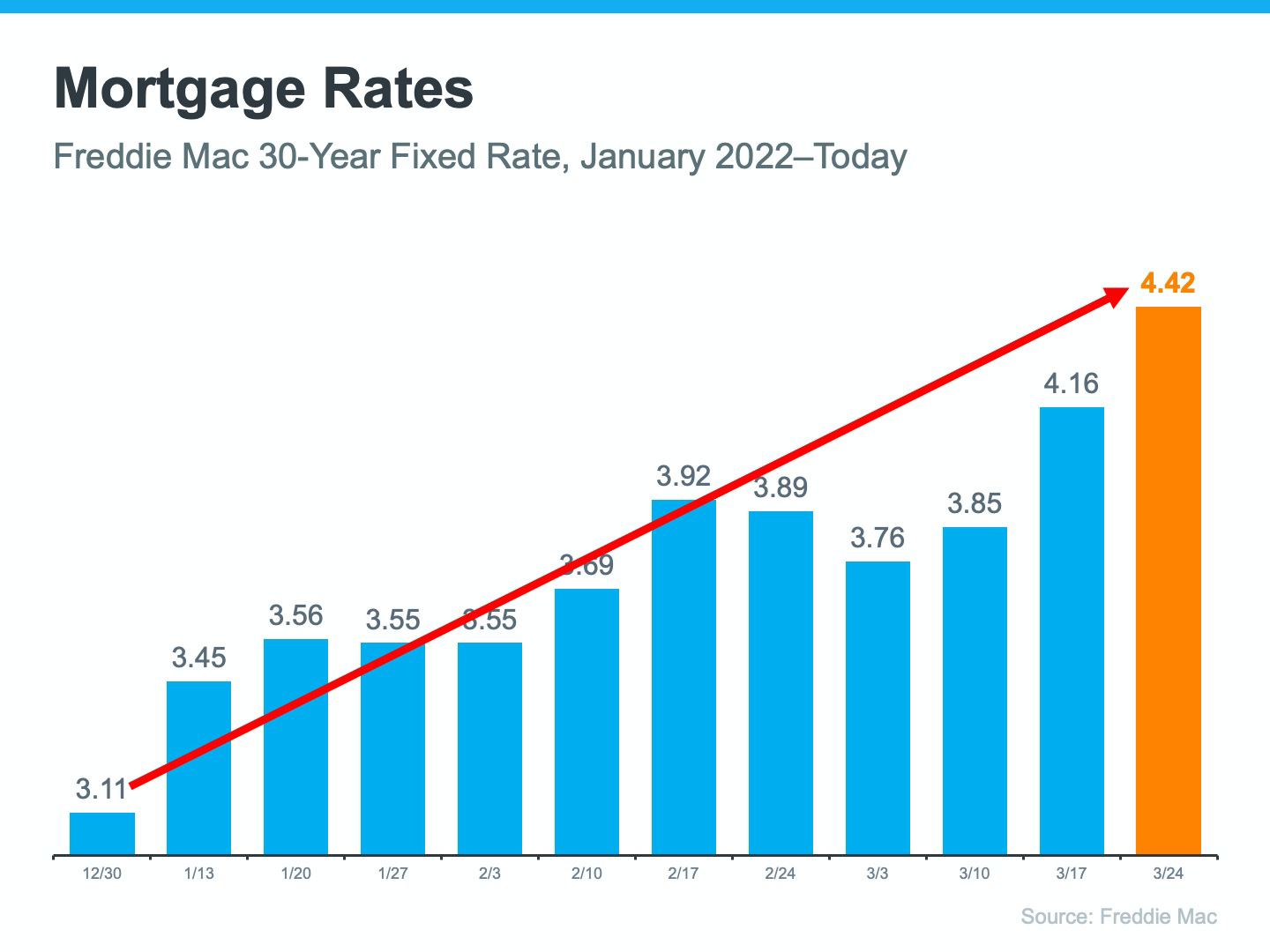

Interest Rates (Jan 2022- March 28th)

What does this mean if I am a buyer?

With interest Rates starting to increase it is more affordable to purchase sooner rather than later on in 2022. More homes should be coming on the market as we go into the spring and summer months.

What does this mean if you are a seller?

We still only have a few weeks of inventory but are starting to see more homeowners put there home on the market. More homes on the market means more competion. We have yet to see a decrease in buyer demand due to the increasing interest rates but we may start to see more homes sell for fjust full price or not so much over asking. If you are planning to sell your home and purchase a new home sooner may also be better. sell while demand is extremely high and rates are still relatively low.